How To Make Money In Gig Economy?

Did you know? Modern technology intertwining with the retail sector gives birth to the ‘Gig Economy.’ This innovative approach to earning a living offers a level of freedom and flexibility that starkly contrasts the traditional 9-5 job culture, piquing curiosity and interest in this evolving employment landscape.

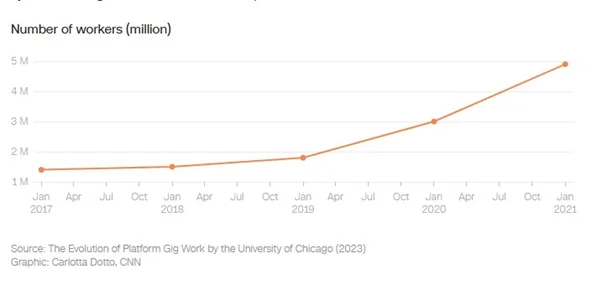

Recall the challenging period of COVID-19, when the global economy was in upheaval. While it impacted all forms of employment, the gig economy demonstrated its resilience, particularly in the surge of app-based delivery jobs. It presented a new avenue for employment and empowered individuals to earn during unconventional times, instilling a sense of hope and optimism for the future.

If you want to be your boss or dream of maximizing your earnings, you can start by taking the first step toward the gig economy. According to Statista, approximately 56% of gig economy workers are in the United States. Freedom to work and flexible working timing attract people to the gig economy in the US.

Many gigs exist, from food delivery to data entry, moving services, and more. Are you interested in trying this new way of earning? Follow this guide by GigsCheck expert writers and editors to learn how to make money in the Gig Economy.

Definition of Gig Economy

The Gig Economy, also known as the sharing economy, offers a world of flexible, temporary, or freelance jobs that often involve interacting with clients or customers via an online platform. It’s a new frontier of work that, while posing challenges to traditional full-time workers, also opens up exciting opportunities for those seeking a more dynamic career path. This shift in the work landscape empowers individuals to take control of their careers, offering them the freedom to choose when and where they work.

From a McKinsey’s America Opportunity survey, 36% of the respondents had claimed their statuses as independence workers; wow! That represented close to 60 million of the U.S. folks.

At the heart of the gig economy’s growth is technology. It’s not just a tool, but a primary driver that has made the gig economy more standard and available to people. The rise of digital platforms and online marketplaces has revolutionized the way work is done, creating new opportunities and challenges. Before diving into this new world of work, it’s essential to understand the role technology plays and how it’s shaping the future of work.

As of 2023-24, experts predict a massive expansion of the U.S. gig economy. This is not just a trend, but a significant shift in the way people work. Millions take it more than just a side hustle and use various modern online platforms to earn money. For instance, during the COVID-19 pandemic, app-based delivery platforms like DoorDash and Uber Eats surged in popularity because people sheltered at home and turned to online delivery. This is a clear indication of the gig economy’s resilience and potential for growth.

Two Things To Consider Before Entering The Gig Economy

Manage Taxes

Being a freelancer is never easy, particularly when managing your taxes. These may be the last things on your mind when you’re hustling to chase the money; however, note that this should be prioritized.

As a freelancer, you pay regular income taxes and self-employment taxes, which can significantly impact your tax liability. Earning more money means paying more taxes, including these self-employment taxes!

According to the IRS, you must file a tax return if your earnings from gig work, freelance, independent contractor (1099), or any other self-employment is $400 or more.

When you get used to having taxes deducted straight out of your paychecks through your employer, the time has come when you’ve got to manage your money flows for future tax bills by yourself—mind it!

You aren’t backed by any financial team anymore. However, as a freelancer, you also have the opportunity to take advantage of various tax deductions, such as home office expenses, business travel, and professional development costs, which can help reduce your overall tax liability.

Thus, it would be beneficial to seek the assistance of professionals, such as an accounting firm or a registered agent. These experts can help you set up a legal entity, guide tax planning, and ensure compliance with tax laws, among other services.

Selection Of Right Gig

After thinking over it more than a hundred times and already coming up with a plan about why the gig economy is good for you, Choosing the cheerful ‘GIG’ is necessary. Each job differs from the other, so it’s of utmost importance to confirm assessing your skills and personality and planning toward your goals!

It is tempting to grab the first thing on your path, especially if you urgently need money. However, this might cause problems and headaches if you’re unprepared. It’s better to allot time researching potential gigs you might work on and check which ones suit you best Based on your skills and personality.

The 5 Most Popular Side Gigs In The United States 🇺🇸

Practically, there are several significant opportunities with side gigs that you can try in the United States and earn money, but here are the top 5 significant gigs you may choose from:

- Uber, a ride-sharing app, allows people to use their car and smartphone to transport passengers, even if they must pass a background check! Uber has gotten into about 70 countries all over the place, making it a practical way for people globally to earn some green! What you make, money-wise, drives for Uber fluctuates based upon where you are. Times of Day. And how current demand does. Not to mention how much you ride with passengers.

- Lyft, a flexible rideshare service, is available in the US and Canada. Like Uber, Lyft drivers use their vehicles to transport customers and are required to pass a background check. Earnings depend on various factors such as location, time of Day, demand, and the driver’s availability, offering a sense of empowerment as you can choose when and where to drive.

- DoorDash, a food delivery service operating in over 300 cities, offers a unique opportunity for independent contractors known as Dashers. Using the DoorDash app, Dashers can accept restaurant food orders and deliver them to customers’ homes or businesses using a car, scooter, or bicycle. The compensation, which varies based on factors such as the time and distance of the delivery, offers a sense of freedom as you can choose your mode of transportation.

- Uber Eats is knocking horns with DoorDash (also another extension of the Uber taxi-hailing service). Food plus drink delivery solutions are provided all through the US. It’s not a MUST for you to be an already Uber driver for delivering with Uber Eats (yet, a background check from Uber remains a Must). In line with DoorDash! You can supply food to client locations using a bike or scooter; payments are hinged on personal locale and how long you haul for the delivery.

- Instacart paves its way as a service for delivering groceries in the US and Canada! Independent shoppers take delivery gigs via the Instacart application, make grocery purchases, and send goods to customer locations. The dough one makes varies with the bulk of individual orders and the distance voyaged; besides other elements, Instacart buyers must clear a must-pass background check.

- You were probably thinking about Digital Freelance Services and finding professional talents using freelance models when we thought about an example of a Gig economy! These are what sites like Fiverr, Upwork, Indeed, and Freelancer are known for Allowing businesses to connect to freelance talent that can quickly fill their skills gaps! And helping them scale up for a brief period.

Looking To Borrow Money?

Are you a Gig Worker or a Freelancer? We’ve got Personalized Loans designed just for you! Take a look at our app now! It’s safe and easy to use. These personalized offers are tailored specifically for gig workers like you, making your financial journey smoother.

So don’t hesitate for a moment; curiosity killed no cats here! Apply now to get the best payday loans for gig workers. The application process is as easy as pie—easier than figuring out the tax forms! Join us to look it over today, and let’s kickstart new journeys. And hey, it’s made just for you gig workers because you all deserve it!!